💳On-chain credit risk

TLDR can be found in this Twitter Thread

Alternative credit applied to on-chain dataHistorically, credit scoring is a mix between cultural psychology and statistics.

Age, gender, occupation, spending patterns, income slips, where the person lives,…you get the idea.Recently, this process increasingly relies more on Big Data, particularly “alternative credit information” that we all leave behind as digital footprints (shopping behavior, social media usage, and telco/internet usage).

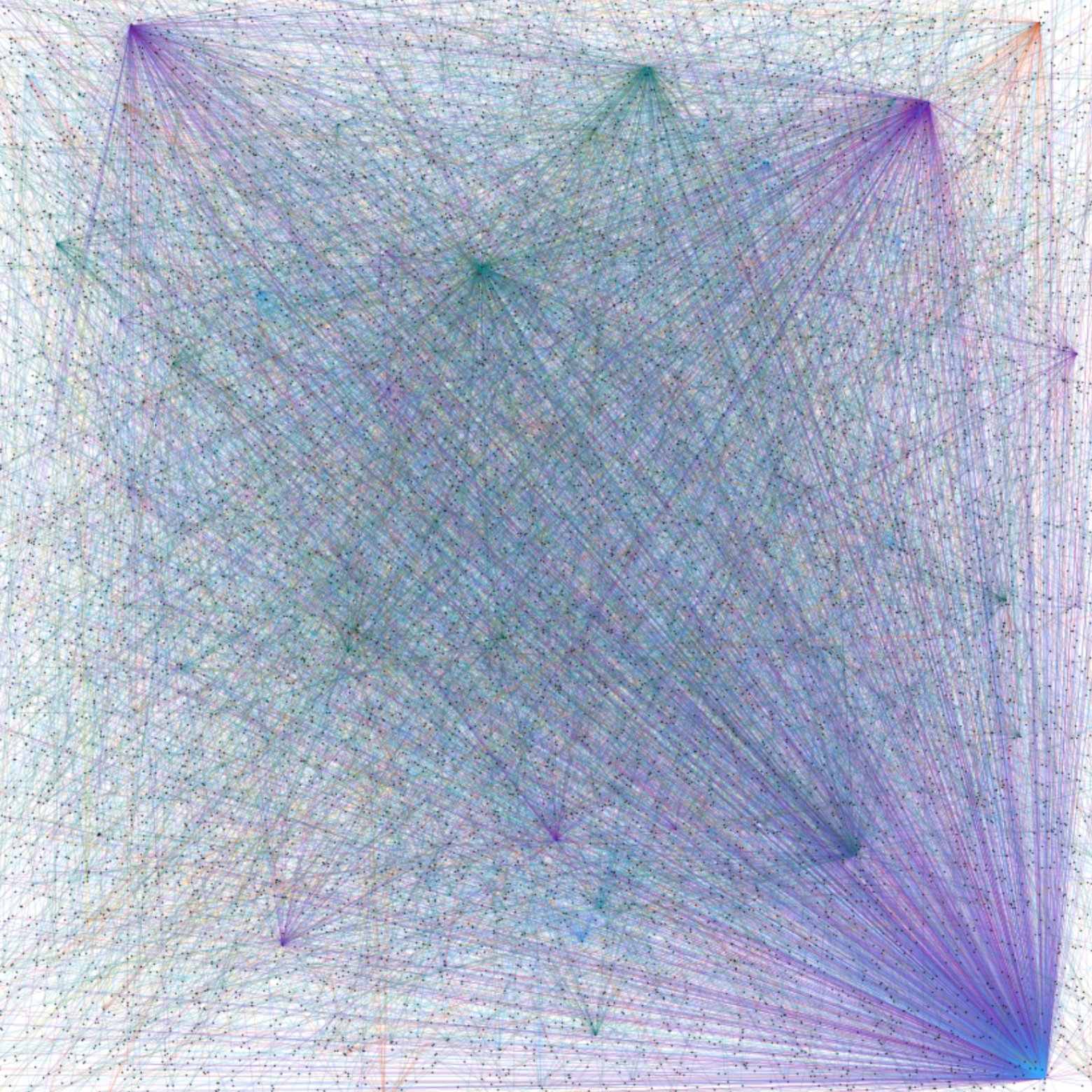

Alternative lending is a lending practice where underwriting is powered by alternative credit information, i.e. a set of information that indicates someone's credit worthiness but was previously under-utilized. The task at hand is how to relate on-chain data to creditworthiness of the person behind a wallet address.

Methodology

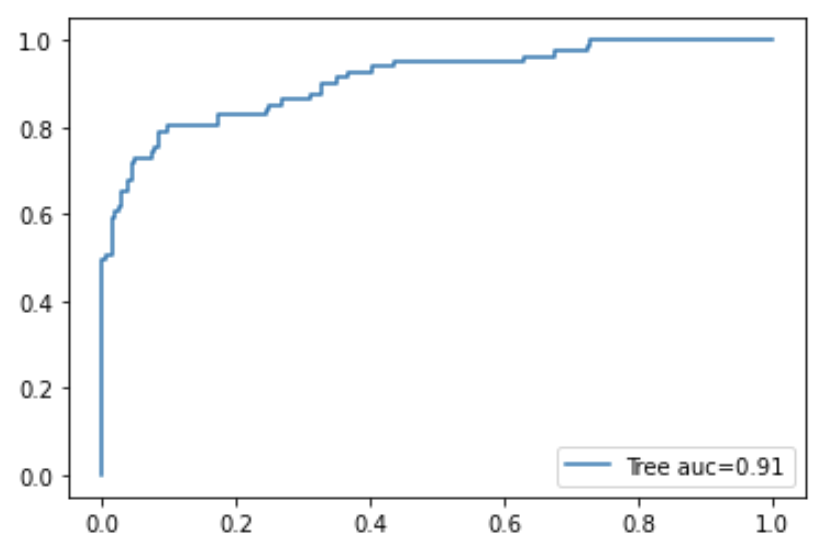

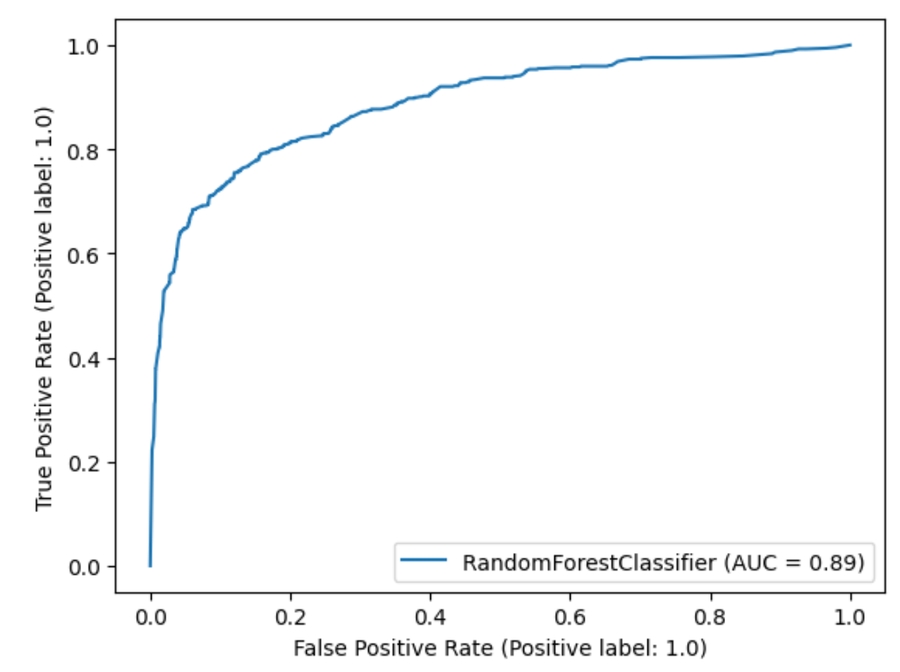

To measure creditworthiness, we operate our zero-collateral lending operations through a service called "The Lending Lab." The lab has provided zero-collateral, zero KYC, lending service since April 2022.We then use the repayment data to train various machine learning models and construct scorecards which can be used by the Lending Lab, our partners, or users themselves if they choose to request a credit history in the form of Atadian Pass.

Scorecards

We actively maintain 2 scorecards. Each measures different things.

1.Web3 Credit Score - this is constantly trained from the data from our Lending Lab

2.Collateralized Score - this is constantly trained from the data provided by our DeFi, NftFi partners

Predictive factors

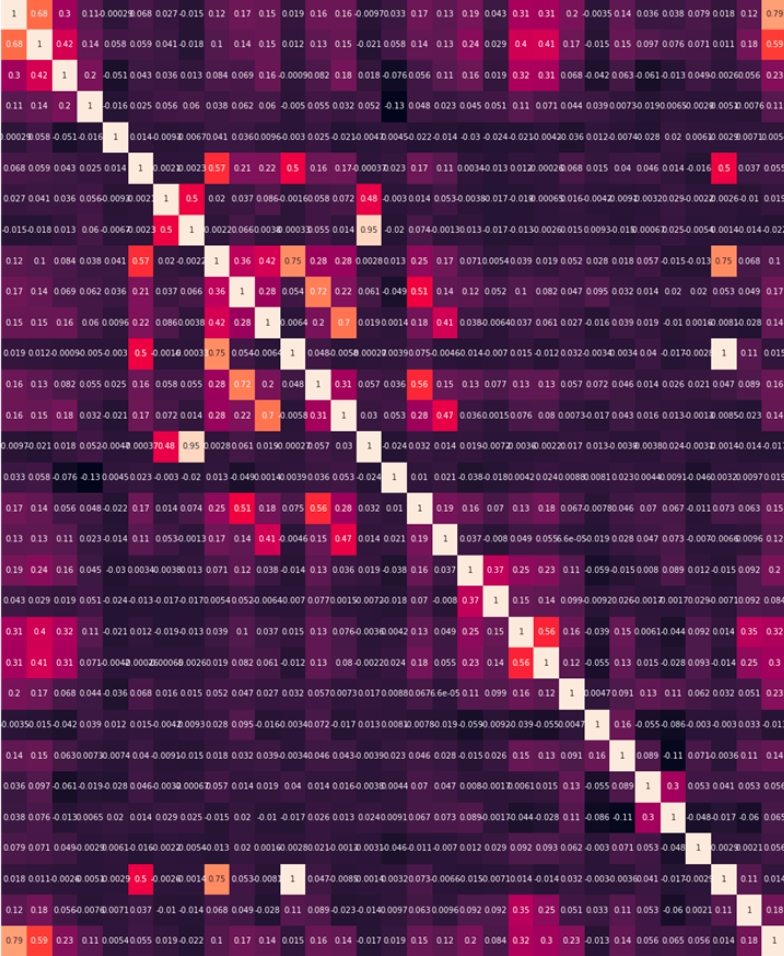

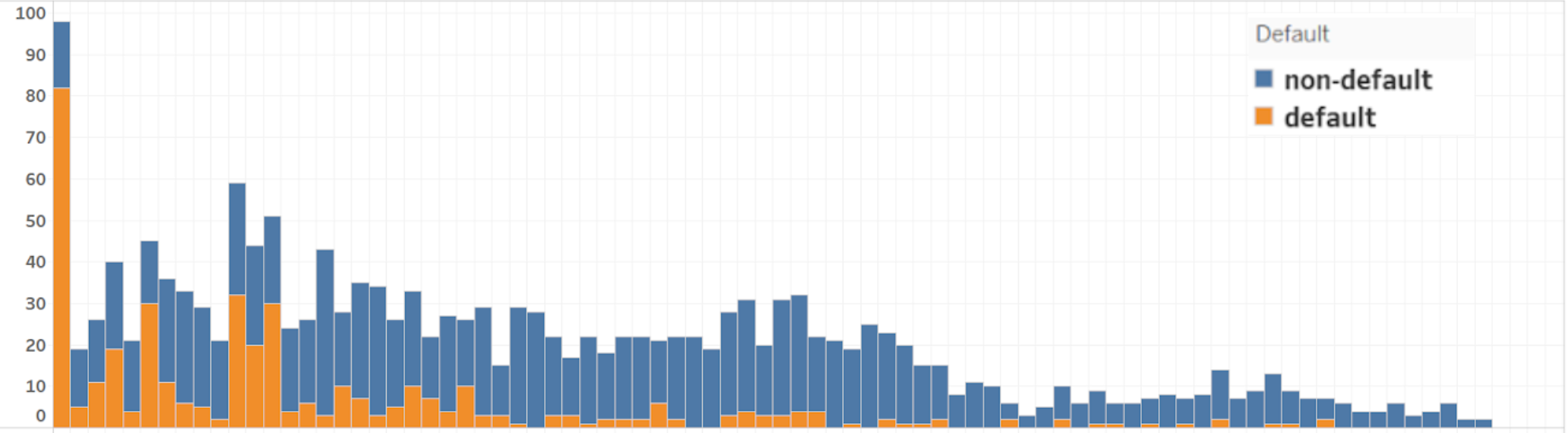

Over the past few months, we've done a LOT of exploratory data analysis and have shortlisted key factors that related to default risk.

Above are examples of factors as they relate to default status.

After a few months of R&D, we are now confident that there is clear evidence that defaulters and non-defaulters exhibit different on-chain behaviors prior to the loan disbursement. It is worth pursuing this further.

Due to the fact that we also underwrite loans, we are not yet comfortable with sharing 100% of our credit scoring model inner-workings. We do, however, have intentions to strive for more transparency than IRL. If you would like to learn or ask due diligence questions about the models, we are happy to chat.

Questions?

If you're looking to integrate the scores, we are happy to share more details in private. Please contact us at contact@atadia.io.

Last updated