👌Lend tokens

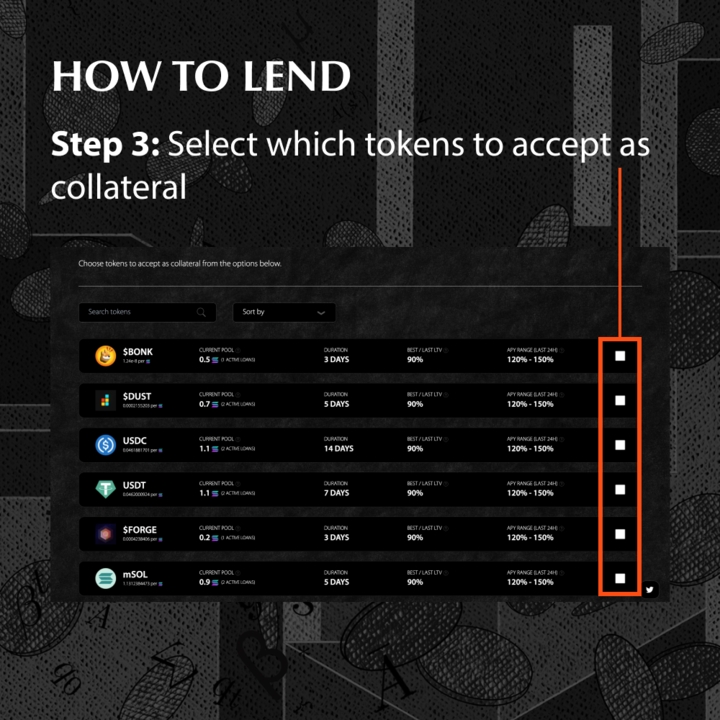

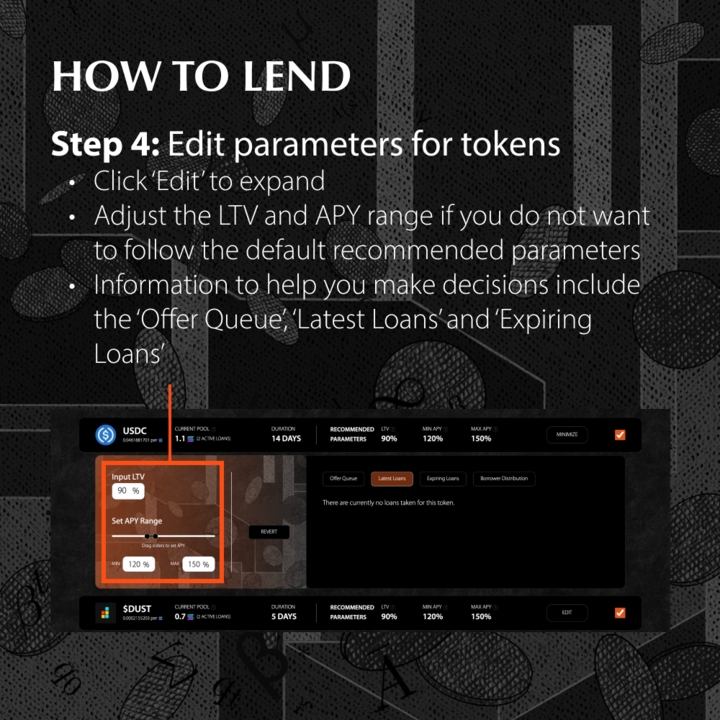

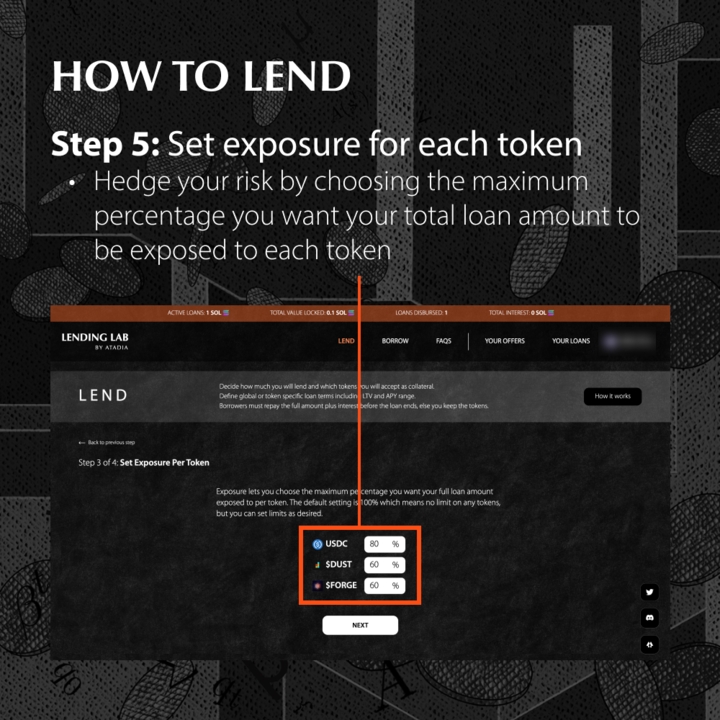

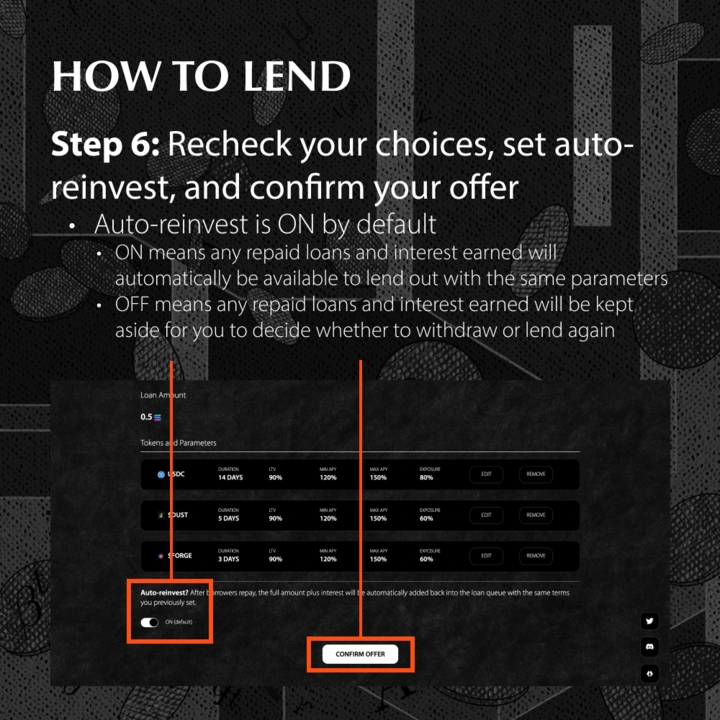

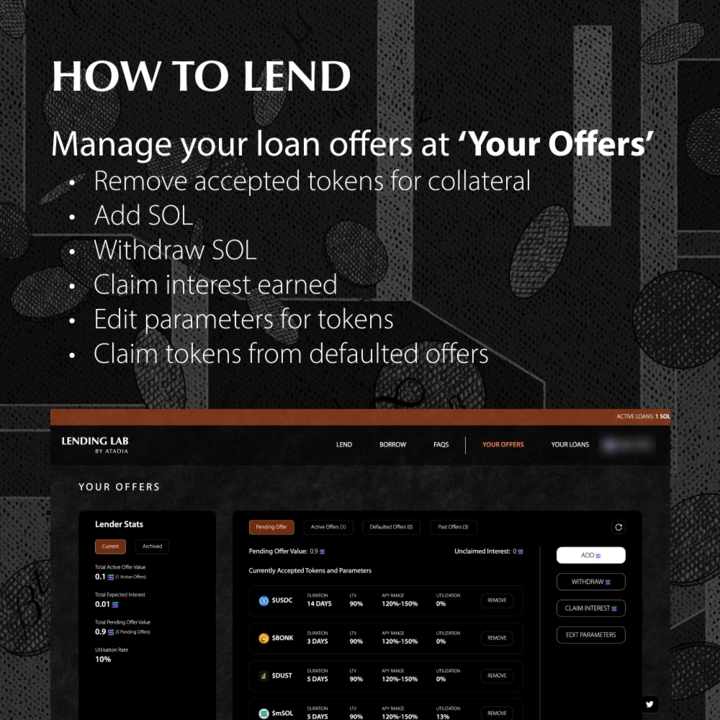

For each token, lenders set the LTV, the minimum APY, the maximum APY, and the maximum exposure they are willing to accept.

Based on all these criteria, all loan offers are queued in order to find borrowers.

Lending Lab does recommend minimum and maximum APY ranges to lenders which are based on the utilisation rate of each token’s pool.

Tokens with high utilisation (low liquidity) are recommended higher APY rates to stimulate lending while tokens with low utilisation (high liquidity) are recommended lower APY rates to stimulate borrowing. Lending Lab handles everything in the back to match lend offers and borrowers to give both the best deal.

Additional Terms & Conditions

Loan durations are set by default for each token

Interest fees are calculated for the entire duration for the loan i.e. even if you pay earlier, you will still pay the full interest amount.

Each wallet cannot borrow more than 80% of the total available loan amount for each token

Repayments must be made by expiry deadlines or the loan is considered defaulted and collateral tokens become the property of the lender. There is no grace period.

The Lending Lab takes a platform fee of 15% for each loan. However, this is reduced by 50% for OGA and VOGA holders

Last updated