$ATA Staking

How $ATA Staking Works

$ATA staking is designed to skew rewards towards the more highly convicted and to absorb $ATA in the early days while products are being built.

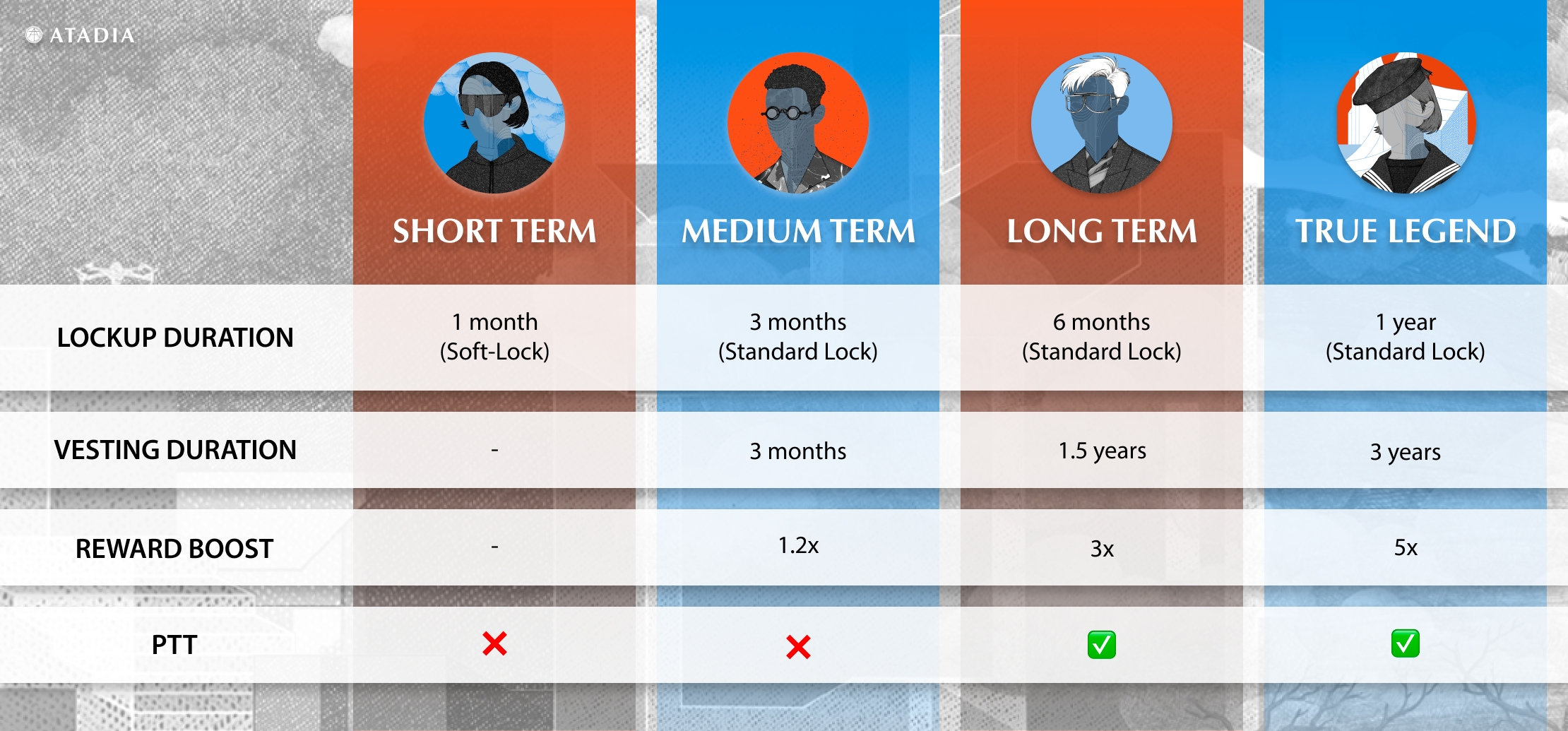

There are four staking options made for investors with differing preferred time horizons. The longer the commitment, the higher the rewards.

Here’s how it works mechanically:

Every 3 days, an amount of $ATA becomes “active,” meaning that it is to be split among stakers according to their staked proportion. If your staking proportion makes up 10% of the whole pool, then you will earn 10% of the active $ATA reward.

Your staked proportion, however, can be “boosted” by up to 5 times by committing to longer lock durations.

As long as your principal remains staked, interest accumulates at the rate initially selected.

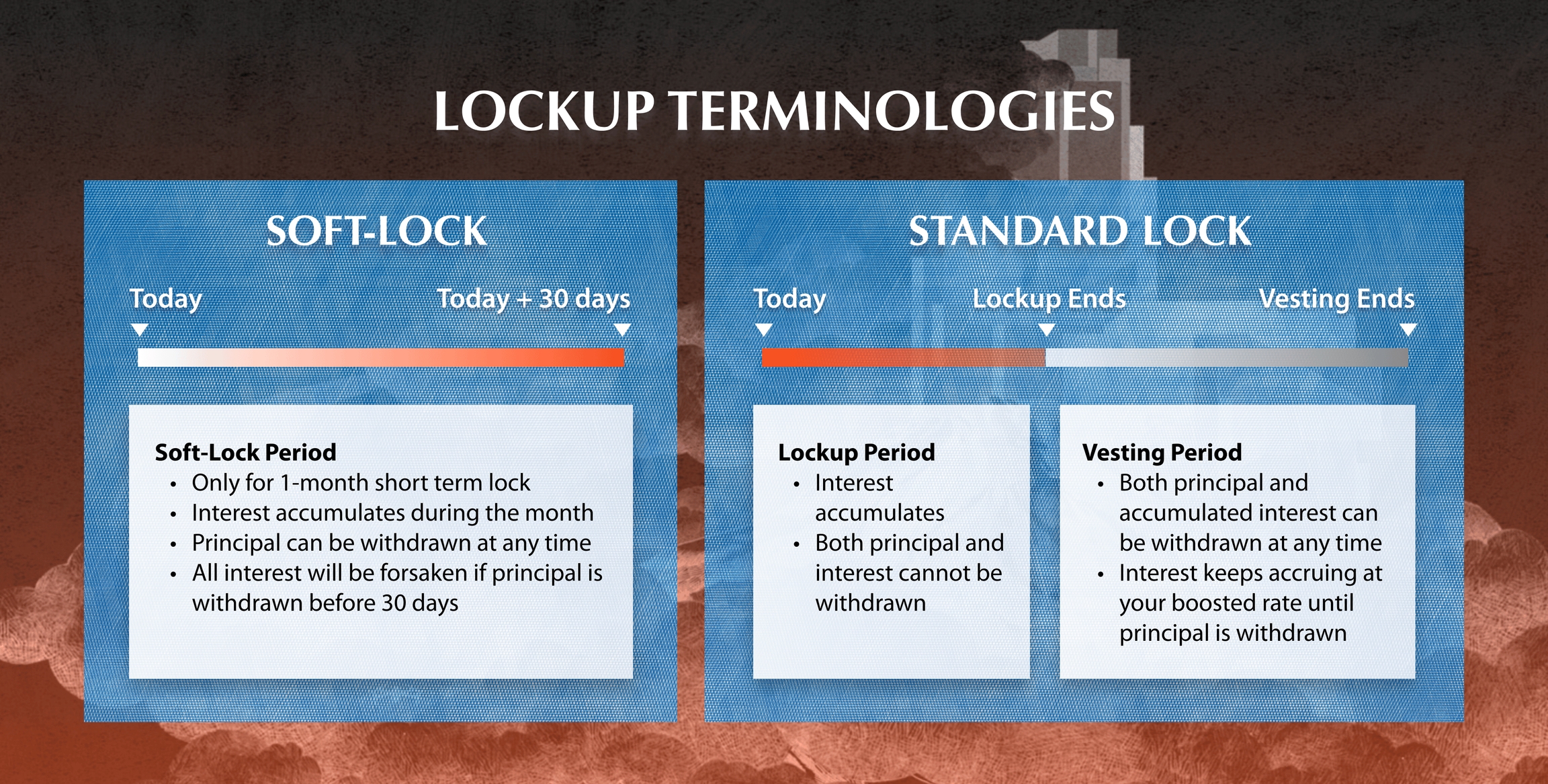

If you choose to “soft-lock” for a month, you are free to withdraw the principal at any time. However, all accumulated rewards will be forsaken if principal is withdrawn before the lock-up duration ends.

If instead you choose “standard-lock,” i.e. locking for 3 months or more, interest accumulates for the whole lockup period but both principal and interest cannot be withdrawn until vesting period arrives.

During the “vesting period,” stakers can continue to earn at their boosted rate, but are also free to withdraw at any time. Once withdraw, reward accumulation stops.

Atadia reserves the right to adjust the reward formula to ensure that our motivation packages are competitive and are compatible with the rest of the ecosystem.

Due to project pivot, $PTT token is delayed until it makes sense to resume credit scoring operations

Last updated